There’s a quiet force at work in the financial world, a silent engine, a process so fundamental yet powerful that it can shape the course of your wealth. Grasping this concept as an investor can enable financial growth on an extraordinary scale. It is the force of compounding.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”

Albert Einstein

I often wondered how people could turn their modest savings into large fortunes through investing in the stock market. It is one of the things that caught my interest about investing in the first place. If this also caught your interest, then let us have a look at how compounding interest can benefit your portfolio.

What is compounding, and why is it so powerful?

Compounding, at its core, is the process where the returns earned on an investment are reinvested to generate their own returns. Over time, this process yields exponential growth, catapulting the value of your investment skyward.

For example, if you have $5,000 invested that yields a 7% annual interest rate, then your account grows to $5,350 after one year – the original $5,000 plus $350 earned as interest. Leaving this sum untouched, the interest in the second year is calculated on the new total of $5,350, resulting in $374.50 as interest. This brings your total to $5,724.50. The interest you earned in the first year ($350) has earned interest of its own in the second year ($24.50). That’s compounding at work.

Now let’s fast forward 30 years, assuming you add no additional money to this account. Your initial $5,000 will have grown to almost $38,061 due to compounding. The beauty of this process lies in the fact that your wealth has increased more than seven-fold without you having to invest any more of your own money after the initial $5,000.

If you want to tinker with your own numbers the US government has an official compound interest calculator at investor.gov.

What annual returns can I expect in the stock market?

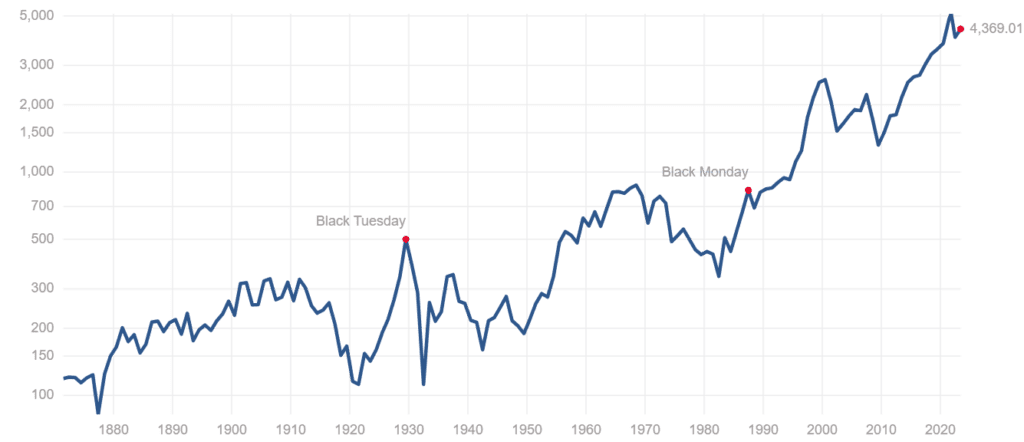

An investor’s best friend is historical data. It allows us to identify patterns, understand trends, and gauge potential future performance. In this section, we’re going to turn our attention to the S&P 500, a stock market index tracking the performance of 500 of the largest companies listed on stock exchanges in the United States. The S&P 500 is considered a leading indicator for the U.S. economy and a benchmark for global equity markets.

The S&P 500, since its foundation in 1957, has weathered storms such as recessions and financial crises. Yet, it has proved resilient and consistently provided substantial returns over the long term.

The average annual return of the S&P 500 index, adjusted for inflation and inclusive of dividends, has been around 7% from 1957 to 2020. This figure is highly significant because it serves as a realistic expectation for investors planning to invest in a broad-based index fund that tracks the S&P 500.

The historical data for the performance of the S&P500 index, adjusted for inflation, can be viewed in the following graph:

Understanding the S&P 500’s history and its average return is fundamental for two reasons. First, it provides a context for the 7% return rate we often associate with stock market investments. Second, it serves as a potent reminder of the power of staying invested in the long term. Despite short-term volatility, the stock market has historically rewarded patient investors, with compounding playing a significant role in boosting these returns.

Learn more about the history of the stock market.

Great, but how does compounding work for my investments in the stock market?

Compounding does wonders when applied to stock market investments. When you buy a company’s shares, you essentially become a part-owner of that company. As the company profits, the value of your shares increases, leading to capital gains. Furthermore, many companies distribute a part of their profits as dividends to shareholders.

Choosing to reinvest these dividends to buy more shares will further boost the cycle of compounding. These additional shares can further appreciate in value and possibly yield dividends, creating a powerful cycle that accelerates the growth of your investment over time.

For example, let’s assume you invest $20,000 in the S&P500 index, which on average yields a 7% annual return on your investments, adjusted for inflation and inclusive of dividends. In the first year, your investment grows by $1,400 to $21,400. This approach, over a period of 30 years, can grow your initial investment to nearly $152,245. And remember, this significant growth has been achieved simply by reinvesting dividends and letting compounding work its magic.

Look for accumulating shares and funds, often denoted by ACC, if you want your dividends to be automatically reinvested. This will save you time as well as money on fees having to purchase new shares.

Legendary investors who made fortunes through compounding

Warren Buffet

Known as the Oracle of Omaha, Warren Buffett is a testament to the power of compound interest. Buffett made his first investment at the tender age of 11, and today, he’s one of the wealthiest individuals globally, with a net worth exceeding $100 billion. His strategy is simple and effective: he invests in businesses he understands and believes in, then holds onto those investments for the long term, allowing the earnings to compound.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest”

Warren Buffet

John C. Bogle

Often referred to as “Jack”, Bogle was the founder of The Vanguard Group, one of the world’s largest and most respected investment companies, known for popularizing index funds. Bogle firmly believed in the power of simple, long-term investing and touted index funds as the ideal investment vehicle for the average investor.

“Don’t look for the needle in the haystack. Just buy the haystack!”

John Bogle

By this, he meant that instead of trying to pick individual winning stocks (the needle), investors should simply buy a low-cost index fund that tracks a broad market index (the haystack).

The S&P 500 Index Fund was one of his preferred “haystacks”, and he encouraged investors to stay invested in such funds for the long term, allowing their returns to compound. Bogle’s own wealth, though not as publicly known as Buffett’s, was substantial and built through the same patient, long-term investing principles. His strategies have influenced countless investors and underscore the power of steady, compounded returns in wealth creation.

In conclusion: buy, hold, buy more, and keep holding

Compounding is the cornerstone of sustainable wealth creation. The earlier you start investing and the more consistently you reinvest your earnings, the more you allow compounding to unleash its power, potentially leading to exponential growth of your wealth.