At first, I thought that the history of the stock market was not relevant, simply because I am investing today, and history is the past. Besides, past events do not guarantee future performance. However, after becoming a more seasoned investor I realized how wrong I had been. The history of the stock market demonstrates the exceptionally strong fundamentals which enables a steady growth over centuries despite various catastrophic world spanning events. Therefore, the history of the stock market is what enables us to lean confidently on our investments, especially if you are investing in broad indexes.

The stock market, for centuries, has played a crucial role in the global economy. It has been a hub for capital and investments, fueling economic growth and development across nations.

Let’s look at the rich history of the stock market, with a specific focus on the performance of the S&P 500 index in the United States. We will also explore the rationale behind long-term investments and how they promise significant returns owing to the principle of compounding interests.

The birth of stock exchanges

The concept of stock markets dates back to the 17th century with the establishment of the Amsterdam Stock Exchange, now known as Euronext Amsterdam. Here, the Dutch East India Company became the first company to issue bonds and shares of stock to the general public.

The stock market across the pond

It wasn’t until the late 18th century that the idea of a stock exchange crossed the Atlantic. The New York Stock Exchange (NYSE), established in 1792, started under a buttonwood tree on Wall Street, where 24 stockbrokers signed the Buttonwood Agreement. This paved the way for regulated trading in the United States.

The S&P 500 index

In 1957, the Standard & Poor’s 500, or S&P 500, was introduced by the financial services company Standard & Poor’s. This stock market index tracks the performance of 500 large companies listed on stock exchanges in the United States, providing a broad snapshot of the U.S. equity market.

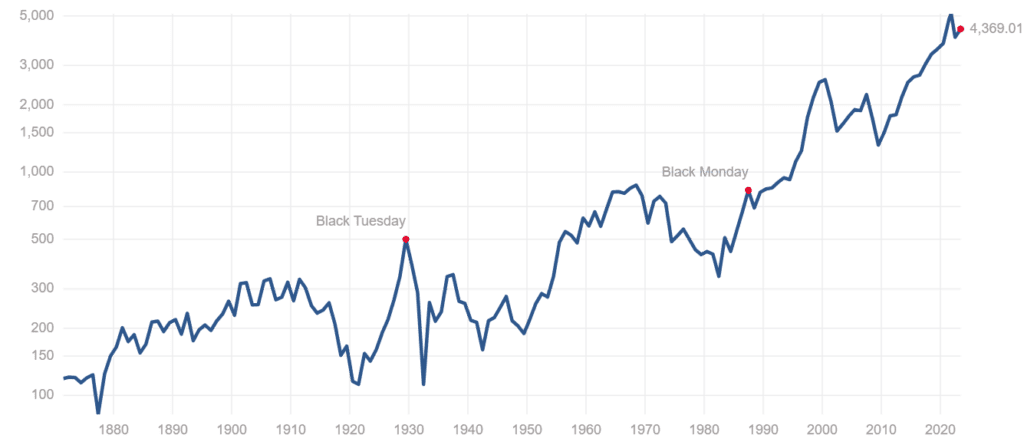

The following chart provides a complete look at the index’s performance adjusted for inflation:

The S&P 500 chart shows numerous dips and spikes, reflecting various economic events. Despite recessions, market crashes, and periods of uncertainty, the market has consistently rebounded and continued its upward trajectory over the long run.

The power of compounding interests and long-term investments

A key understanding when looking at these historical returns is the power of compounding. Compound interest works on the principle that interest is earned on initial principal and the interest that has been added to that initial principal – it’s interest on interest.

This is where long-term investing plays a pivotal role. The more time you give your investments to grow, the more you can take advantage of the power of compound interest. And the less likely you are to be impacted by short-term volatility. As Warren Buffett once said, “Our favorite holding period is forever.”

Compounding interest and how it can propel your wealth.

The historical average return and risk mitigation

Data on the history of the stock market indicates that investing in stocks has proven to be one of the most effective ways to grow wealth. As we’ve seen, the average annual return has been around 7% (inflation-adjusted) for the last century or so. This historical average return acts as a cushion against risks associated with short-term market volatility.

This does not eliminate risk entirely – the stock market is inherently risky – but it does mitigate it to a significant extent. It’s important to remember that while history can be a good guide, it’s not a guarantee of future performance. That being said, long-term investing, fueled by the power of compounding and supported by historical returns, has consistently proven to be a solid strategy for wealth creation.

The most profitable investment strategies for the stock market